General situation real estate market Spain

Inflation remains high but is slowly declining, with an average inflation rate of 6.1%. The European Central Bank raised interest rates, although with a smaller increase than before.

The number of new mortgages for home purchases dropped in the first four months of the year. The number of property sales also decreased, though less sharply. From this, you can conclude: more people bought a house using financial means other than a mortgage. Interestingly, the number of home purchases by foreigners barely decreased. Foreign buyers still have a large share of the number of Spanish properties sold and this is reflected in the availability in popular areas such as Valencia, Costa Blanca, Costa del Sol and the islands, where there has been a decrease in housing supply and an increase in sales prices.

More on Spain’s Q2 2023 property figures can be found here.

Property prices Valencia vs. other regions in Spain

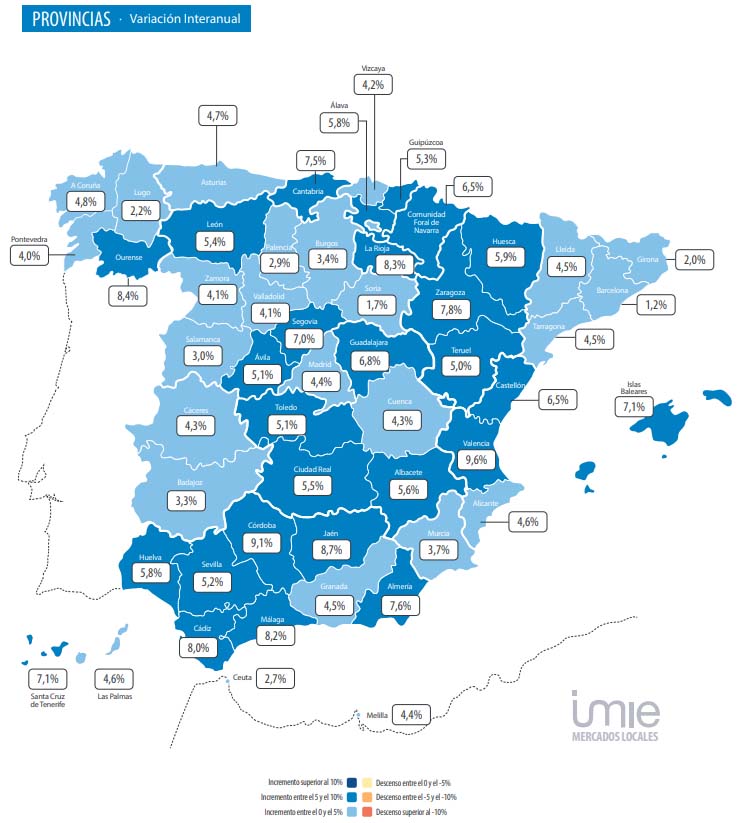

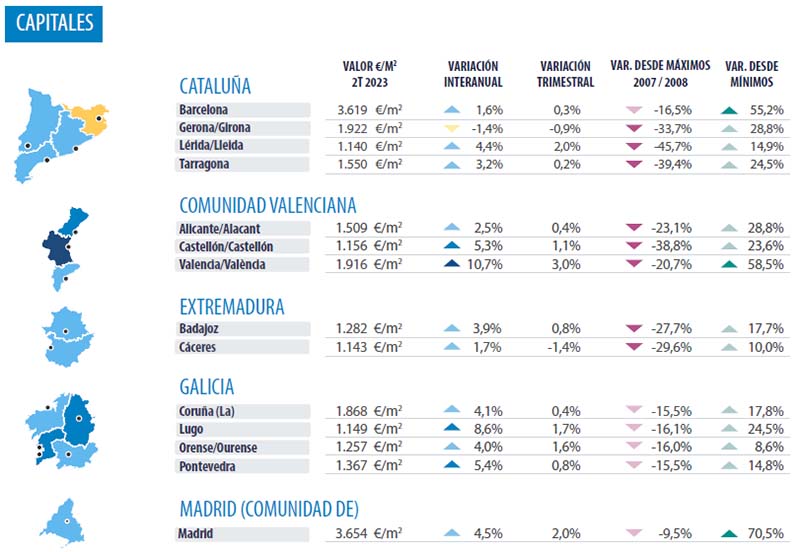

The trend of stabilisation in property price growth in Spain, is not visible in Valencia. To begin with, the year-on-year increase is already high in the autonomous region of Comunidad Valenciana: an average year-on-year increase of 7.4%, where Spain’s average is 4.8%. Other regions where the year-on-year differences are higher than Spain’s average include the Balearic Islands (7.1%) and Andalusia (6.5%).

Incidentally, the differences within the three provinces in the Comunidad Valenciana are also noteworthy. Property prices increased year-on-year by 4.6% in Alicante province, 6.5% in Castellon province and head and shoulders above the rest in Valencia province (which includes Valencia city): 9.6%!

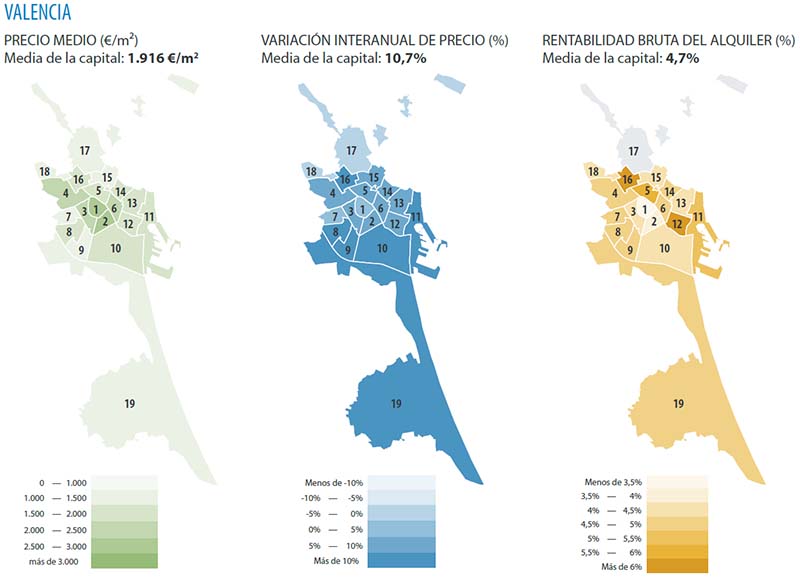

House prices Valencia city by area

Valencia city continues the upward trend of previous quarters. Price increases are becoming even more intense, reaching 15% year-on-year growth in three districts: Patraix, Benicalap and Quatre Carreres. Strong growth of 10% continues in Poblado Marítimo, Jesús and the Poblads del Sud. The biggest quarterly boost is observed in Quatre Carreres and Poblado Marítimo, with an increase of around 5%.

In terms of price per square metre, Ciutat Vella, Eixample and El Pla del Real are still in the top three. This time, however, the average prices sight above €2,300 per square metre, while in the previous quarterly analysis it was still above €2,200 per square metre. But the most important question: is this high? We help with the answer: the square metre price in the centre of London still averages £13.1k (€15.337) and in New York City $15,8k (€14.513,89). But even compared to other popular Spanish cities, Valencia city has an excellent price. Look at Madrid, for example, where the average is €3,654 per square metre and Barcelona, average €3,619 per square metre.

Return on rental Valencia

Conclusion property market Valencia 2023 Q2

Valencia is currently one of the most attractive areas if you want to invest in real estate in Spain. This applies to the entire region, but especially to the city, where supply is becoming increasingly scarce, which in turn affects prices. Especially in the popular neighbourhoods, you can see average square metre prices rising slightly every quarter. A good time to get in so you can join this lift upwards.

The Spanish property market generally shows a stabilisation in the growth of house prices, but popular areas including Valencia still stand out. Foreign buyers have a big part in this. You can see that there are still many buyers for a second home in Spain, or buyers finally realising their emigration plans in combination with the purchase of a dream home.

Want to know in which neighbourhood in Valencia you can find a good flat for investment? Or are you just looking for a house in the province or region? Let us know in a Property Finder Service and we will get to work for you.

If you have any questions as a result of this Valencia property market analysis, feel free to contact us.